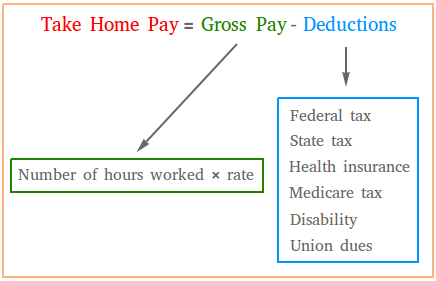

Calculate take home pay

To calculate take home pay, just add all deductions and then subtract the total deductions from the gross pay.

Definition of take home pay: Also called net pay, the take home pay is the money that is left after all deductions have been subtracted from the gross pay.

Definition of deductions: All money taken away from your gross pay.

Definition of gross pay: The amount of money paid to an employee before deductions.

Take home pay = Gross pay - Deductions

A few examples showing how to calculate take home pay

Example #1:

Steve is a computer programmer and he works 35 hours a week. Steve gets paid $25 / per hour. Calculate take home pay.

The following are deductions from Steve's paycheck:

- Federal tax: $130

- State tax : $25

- Health insurance: $80

- Medicare tax: $52

- Disability: $12

- Union dues: $21

First, calculate total deductions:

Total deductions = Federal tax + State tax + Health insurance + Medicare tax + Disability + Union dues

Total deductions = $130 + $25 + $80 + 52 + $12 + $21

Total deductions = $320

Second, calculate Steve's gross income:

Gross pay = Number of hours worked × rate

Here, the rate is how much you get paid per hour

Thus, gross pay = $35 × $25 = $875

Take home pay = Gross pay - deductions

Take home pay = $875 - $320

Take home pay = $555

Example #2:

Amy is a nurse and she works 52 hours a week. Amy gets paid $50 / per hour for regular time and $75 / hour for overtime.

The following are deductions from Amy's paycheck:

- Federal tax: $150

- State tax: $54

- City tax: $24

- Health insurance: $100

- Medicare tax: $45

- 401k contribution: $80

First, calculate total deductions:

Total deductions = Federal tax + State tax + City tax + Health insurance + Medicare tax + 401k contribution.

Total deductions = $150 + $54 + $24 + $100 + $45 + $80

Total deductions = $453

Second, calculate Amy's gross income:

Gross pay = Number of hours worked × rate

Since Amy worked 52 hours, there is overtime pay.

Regular pay = $40 × $50

Regular pay = $2000

Overtime pay = $12 × $75

Overtime pay = $900

Gross pay = Regular pay + Overtime pay

Gross pay = $2000 + $900

Gross pay = $2900

Take home pay = Gross pay - deductions

Take home pay = $2900 - $453

Take home pay = $2447