Take home pay calculator

The following take home pay calculator will help you determine your net pay or take home pay after all deductions have been taken away from your gross pay.No need of paper and no need to do addition or subtraction! Just plug in what you think is the best estimate of your gross pay and all deductions.

Guidelines to follow when using this calculator

When entering numbers, do not use a slash: "/" or "\"After you have entered all values, hit calculate and the net pay will be displayed in the big box below:

A couple of examples showing how to use the take home pay calculator

Example #1:

A man living in Massachusetts works for a company that pays him 16 dollars per hour and the man usually works 40 hours a week. What is the man's take home pay if he has the following deductions from his paycheck.

Contribution to 401(k): 100 dollars

Federal tax: 54 dollars

State tax : 32 dollars

City tax / Local tax: 0

Health insurance : 75

Medicare tax: 20.88

Disability tax: 0

First, notice that we are going to calculate the weekly take home pay since the information we have is for a weekly paycheck.

Then, we need to compute the man's gross wage.

Gross wage = number of hours worked per week × hourly rate

Gross wage = 40 × 16 = 640

After entering the information above in the appropriate field, you should get a take home pay of 358.12 dollars.

Notice that in the situation above, almost half of the man's gross income is gone paying deductions

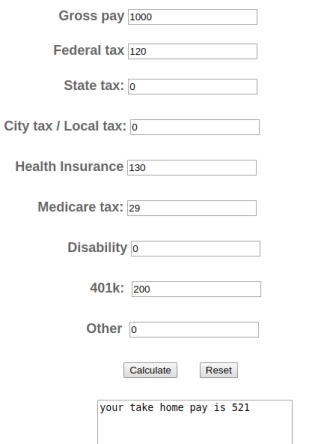

Example #2:

John who lives in Florida works for a BMW dealer as a sales manager. His weekly salary is 1000 dollars. What is the John's take home pay if he has the following deductions from his paycheck.

Contribution to 401(k): 200 dollars

Federal tax: 120 dollars

State tax : 0

City tax / Local tax: 0

Health insurance : 130

Medicare tax: 29

Disability tax: 0

We are going to calculate John's weekly take home pay and there is no need to compute the gross pay since it is already given.

After entering the information above in the appropriate field, you should get a take home pay of 521 dollars.