Adjusted gross income

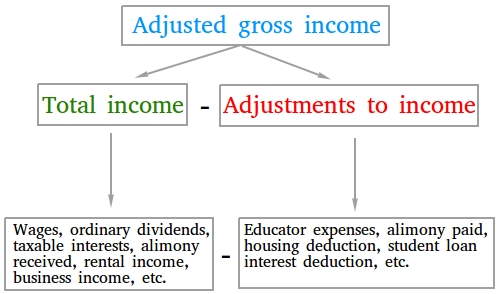

What is adjusted gross income? The adjusted gross income, also called AGI, is the sum of all incomes earned during a year minus any adjustments to income.

As shown in the figure above, the sum of all incomes could include the followings:

- Wages, salaries, tips, etc.

- Taxable interest

- Ordinary dividends

- Taxable amount of IRA distribution

- Taxable amount of pensions and annuities

- Taxable amount of social security benefits

- Capital gains (or loss)

- Other income such as business income (or loss), alimony, rental, gambling, etc.

The adjustments to income could include the followings:

- Educator expenses

- Alimony paid

- Student loan interest deduction

- Self-employed health insurance deduction

- Housing deduction

- etc.

Real life examples showing how to compute the adjusted gross income

Example #1:

In 2009, Peter earned 15,000 USD working part time as a taxi driver. He also earned 200 dollars a week working as a math tutor for 20 weeks. Finally, peter earned 50 dollars of interest income from a saving account. His educator expenses were 500 dollars and he also received a housing deduction in the amount of 2500 dollars.

What is Peter's adjusted gross income?

Earnings = weekly earning × number of weeks worked

Earnings = 200 × 20 = 4,000

Total income = wages + interest income

Total income = 15,000 + 4000 + 50

Total income = 19,050 USD

Adjustments to income = educator expenses + housing deduction

Adjustments to income = 500 + 2500

Adjustments to income = 3000

Adjusted gross income = total income - adjustments to income

Adjusted gross income = 19050 - 3000

Adjusted gross income = 16050

Example #2:

In 2016, William earned 80,000 USD in real states investment. He also earned 50,000 dollars in annuities and 20,000 of interest income. Finally, William made 100,000 dollars with his website selling educational software. William paid a total of 100,000 dollars in alimony and he received a deduction of 12000 dollars in self-employed health insurance.

What is William's adjusted gross income?

Total income = real states income + annuities + business income + interest income

Total income = 80,000 + 50,000 + 100,000 + 20,000

Total income= 250,000 USD

Adjustments to income = alimony paid + self-employed health insurance deduction

Adjustments to income = 100000 + 12000

Adjustments to income = 112000

Adjusted gross income = total income - adjustments to income

Adjusted gross income = 250000 - 112000

Adjusted gross income = 138000

Have A Great Basic Math Word Problem?

Share it here with a very detailed solution!

What Other Visitors Have Said

Click below to see contributions from other visitors to this page...

Calculating Gross Earnings Not rated yet

Bryan works in a men's clothing store. He earns a base salary of $350 per week plus his commission is 5% on all sales. If Bryan's sales in one week total …